In his latest opinion piece Allister Young, Chief Executive of Coastline Housing, talks about the disastrous freeze on local housing allowance announced the day after the recent budget and offers up some very sobering statistics.

At a recent briefing with Coastline colleagues I talked through some of the important things the government announced in the 30 October Budget. I talked about choices: the choices the government can make about what it decides to do; and the choices it can make about how it decides to do those things.

One of the choices the government made as part of the Budget wasn’t actually mentioned on 30 October, but came out more quietly the next day. It was about something called ‘Local Housing Allowance’ (LHA) rates, which they have said will be frozen in April next year.

Some of you will be very aware of the LHA, what it is, and the impacts it can have. But some of you might be less familiar. So I’ll start with a very quick potted history (if you want more – this is a useful starting point).

- The LHA was introduced back in 2008. It applies to private rented housing, and the idea was that it would cap the amount of housing benefit you could receive so that roughly 50% of the homes in the area you lived would have the rent fully paid by housing benefit.

- Since 2011 it’s almost always been either cut or frozen each year. From 2013 to 2020 LHA rates only increased by 4%, while over the same period private rents actually increased by 23%.

- In 2020, in response to Covid-19, LHA rates were increased to cover 30% of homes again. Rates were then frozen again for three years, before being increased again to 30% again in 2024.

What is the effect of this? Well, if in six of the last ten years LHA rates have been frozen, it’s no surprise that lots of people who depend on housing benefit have been struggling to find a home they can afford to live in.

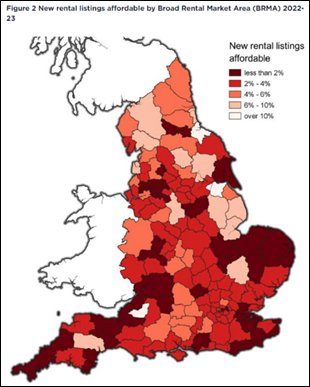

Over that ten year period the proportion of homes in England affordable to someone on housing benefit dropped from around 30% to 5%. In Cornwall, it dropped to less than 2%. Remember, the idea of this policy when it was introduced was that 50% of homes would be affordable!

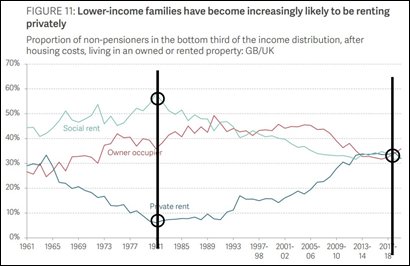

One of the reasons freezing LHA rates is so bad it that it impacts on a LOT of people. In the past people on lower incomes were much more likely to live in social housing than in private rented housing, and therefore wouldn’t be impacted. But over the last 40 years that has changed, and now poorer families are as likely to live in private rent as they are in social housing.

That means there are about 1 million more households on lower incomes (of whom about 400,000 are in work) living in private rent than there were in 1980, and they almost certainly won’t be able to find a private rented home where the rent is covered by housing benefit. Research by the Joseph Rowntree Foundation and Manchester Metropolitan suggests that if the LHA freeze is continued, in four years’ time 50,000 private renters (and 30,000 children) will be pulled into poverty.

So why is the government adopting this approach and squeezing income for some of the poorest families in England? They are trying to reduce the size of the housing benefit bill, which is huge. But they’re trying to solve the problem with a sticking plaster that penalises the very people that need help most.

It’s part of a longer term trend in housing policy, where governments keep trying to fix today’s problem, when they should be thinking about solving the problem for the long term.

For too long, governments have sat back and assumed the housing market will provide the homes the country needs, ignoring the fact that what the market will do is make sure it is making as much money as it can (that’s what markets do!). The result? There are 8.5 million people in England who can’t access the housing they need. Hard working, poorer families, are reliant on expensive, poor quality private rent, and have often given up on being able to secure social housing.

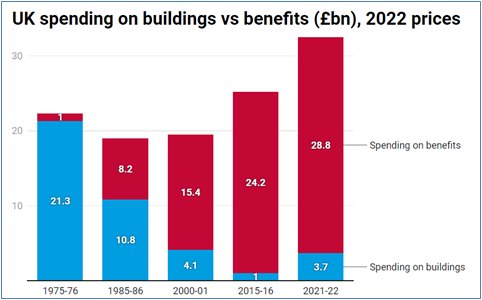

And it’s a financial disaster for all of us. In 1980 the government spent (in today’s money) £22.3 billion on housing, of which 95% was spent investing in buildings, and only 5% on benefits. Now? We spend £30 billion, only 10% of which is on buildings, and 90% is on benefits. That’s crazy, and it makes me mad.

That’s why Coastline continues to support the National Housing Federation’s call for the government to be ambitious, to look past today’s problem, and to set a clear long-term plan to meet housing need. Because a decent, affordable home is as essential as having clean air to breathe, and should be a right for us all, wherever we live across the country.